INVESTING THE RIGHT WAY

The foundation of a successful investment is capitalizing on the market’s mispricing of risk or incorrect discounting of future value.

This requires us to be historically informed and intelligently contrarian — learning things others don’t and understanding things as they are rather than as they are believed to be. Although we are fundamentally bottom-up investors, we do not simply look for investments with lower-than-average price-to-book or price-to-earnings ratios and/or high dividend yields. Any suggestion that such a framework defines value investing is a mischaracterization.

Our approach requires discipline, focus, and conviction. The discipline to only buy at a discount to intrinsic value, the focus to understand an industry and business deeply, and the conviction to hold an investment through market cycles, averaging down when the price trends lower.

INVESTING IN THE RIGHT PLACE

What are liquid real assets?

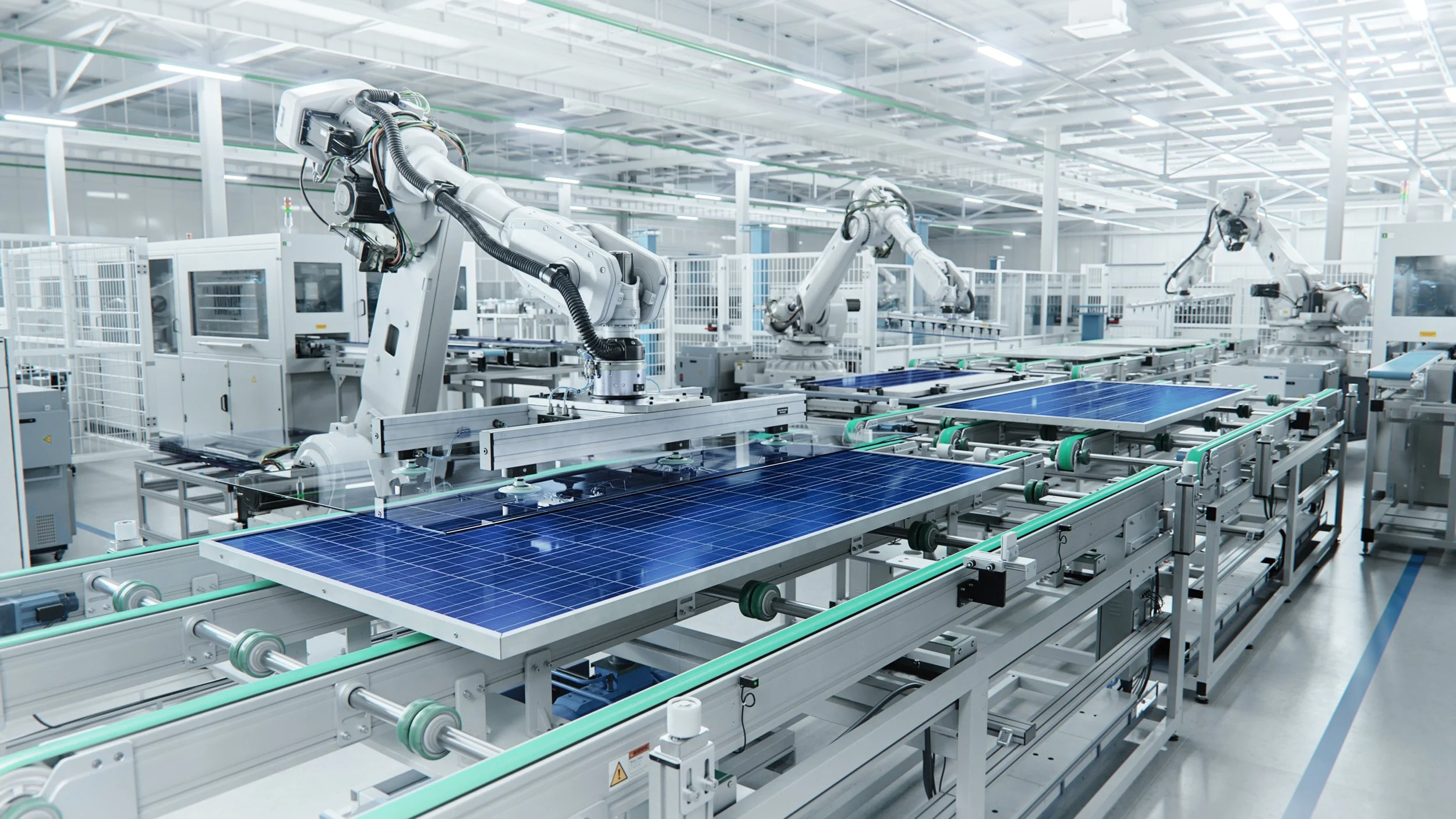

Liquid real assets are publicly traded companies focused on operating assets in Energy, Materials, Infrastructure, and select Industrial Industries. Common operating characteristics of liquid real asset businesses include the operation of long-lived plant and equipment, large upfront capital investment, high rates of real return, significant scientific and technological operating challenges, and diverse geographic operations.

-

Return Potential

Liquid Real Assets offer many of the same benefits as private real assets but with more traditional equity-like capital appreciation potential and superior liquidity.

-

Attractive Income

Liquid Real Assets deliver a real return to investors through yields historically in line with or above that of global equities.

-

Inflation Hedge

Liquid Real Assets have historically acted as a natural inflation hedge, helping investors maintain purchasing power.

-

Diversification

Liquid Real Assets have a low correlation to traditional investment portfolios, broader equity markets, and traditional asset classes.